Your guide to claiming home office expenses at tax time

Now more than ever, our homes are our sanctuaries. But for many they have become a place of work, too. Australians have been forced into isolation amid the COVID-19 crisis with many now assuming their workplace roles from the comfort and safety of their living rooms.

The explosion of working-from-home arrangements means employees now have extra expenses to consider. But what receipts should you be saving for tax time?

Before you race out and purchase the latest tech gadgets, the National Tax and Accountants’ Association is offering some sage advice for those seeking to claim some of their home office costs as tax deductions.

NTAA spokesman Andrew Gardiner says items claimed must relate directly to the work you do from home during the COVID-19 pandemic and be drawn from two main areas – running costs and office-type claims such as the phone and internet.

“In our tax system, the entitlement to the deduction in both cases is fairly straightforward – if you’re working from home then a deduction is available,” Gardiner says.

“The problem we have, however, relates to documentation and the ability to substantiate the expense.”

There are three ways of claiming

1. New “shortcut” method

The Australian Taxation Office (ATO) on Tuesday announced new arrangements to help cater for the influx of employees working from home under coronavirus restrictions.

Under the new model, people can now claim a rate of 80 cents an hour for all running expenses, with multiple people living in the same house able to claim this new rate. The previous requirement to have a dedicated workspace at home has now been removed.

ATO Assistant Commissioner Karen Foat says the new shortcut method, which will initially apply from 1 March to 30 June 2020, will make it easier for those who are working from home for the first time.

“The shortcut method provides a rate of 80 cents per hour and will only require you to keep a record of the number of hours worked from home,” she says. “This recognises that many taxpayers are working from home for the first time and makes claiming a deduction much easier.

2. Fixed rate scheme

Under the ATO’s existing fixed rate scheme, claimants are entitled to a deduction of 52 cents for each hour spent working from home. Records must be kept of actual hours spent working from home and a four-week diary to show your usual pattern of working at home, which is then applied to the remainder of the year to determine your full deduction amount.

Among the items where work-related portions can be claimed are:

- Home office equipment, including computers, printers, telephones and furniture and furnishings. You can claim the full cost for items up to $300 or depreciation for items more than $300 in value.

- Utility bills, including heating, cooling and lighting.

- The costs of repairs to home office equipment, furniture and furnishings.

- Cleaning costs for your work area in your home.

- Other running expenses including computer consumables, such as printer paper, ink and stationery.

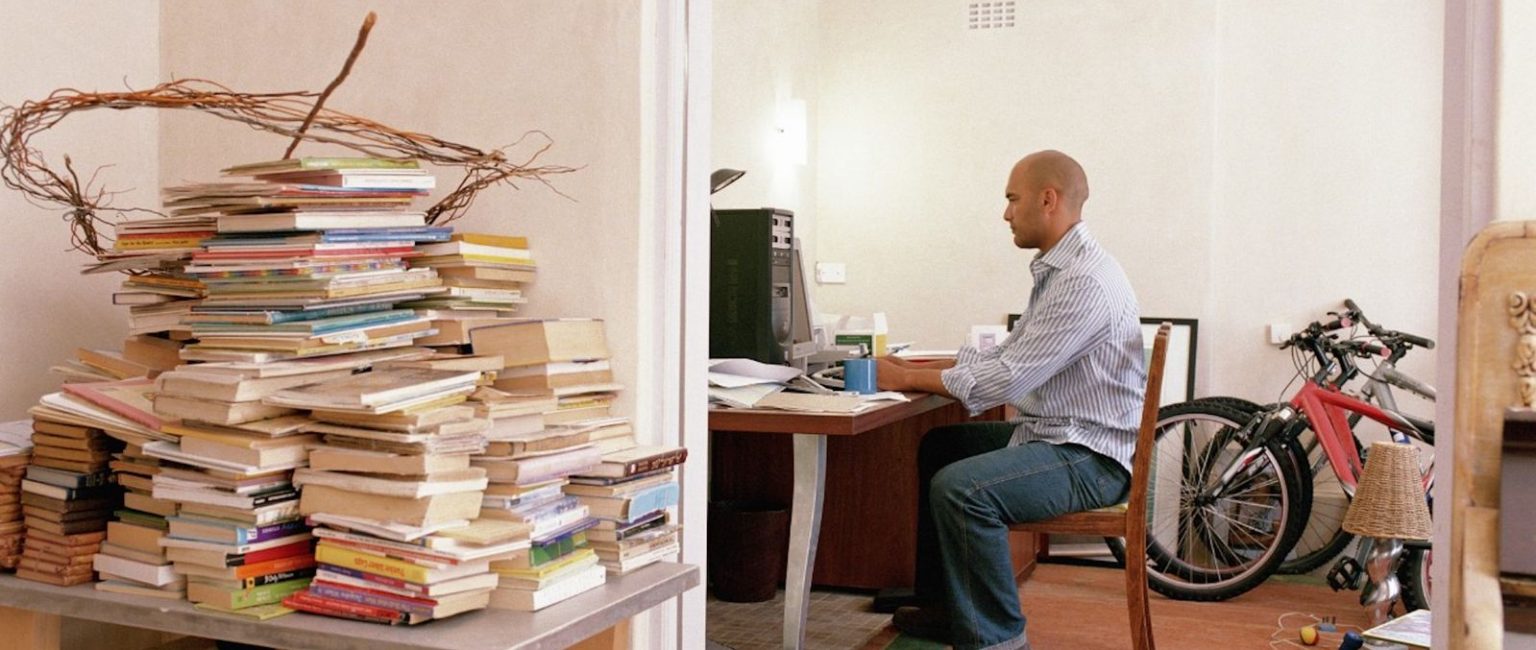

The ATO has made it easier for home office workers to claim expenses with its “shortcut” method. Picture: Getty.

3. Claiming actual expenses

The third option allows workers to can claim actual expenses (see list under point 2), but they need to retain records about how much of the home is used for work purposes and their work times to determine the claim based on detailed analysis.

Gardiner warns this is often a time-consuming process and, in his experience, many people with the best of endeavours fall short because of the onerous record-keeping requirements.

“Very few people are going to maintain the meticulous details necessary, particularly to claim under the second method,” he says.

When it comes to phone and internet claims, employees working from home can claim a flat fee of $50 per taxpayer per year without detailed records.

“The problem we have there is that many people are going to be working from home for a month, two months, in some cases three months…and $50 is not going to go anywhere near close enough to the expense they are actually incurring,” says Gardiner.

Alternatively, he says, taxpayers can keep a four-week diary that records the total number of work calls as a percentage of all calls made. The same process can be undertaken for time devoted to work calls and total data downloaded for work purposes.

What about mortgage interest, rates and land taxes?

Gardiner adds, despite widespread misconceptions, employees are generally not able to claim occupancy expenses such as mortgage interest, rent, rates or land taxes if they are working from home.

“The law and ATO have made it clear that those circumstances are limited to where a room is really used as a place of business,” he says. “The classic example is a hairdresser who has part of the home for that purpose.”

“But if it is just an interim measure because of the coronavirus crisis then by and large the answer would be no.”

The ATO reminds, to claim deductions taxpayers must have spent the money themselves and not have been reimbursed. The claim must also be directly related to earning income and there must be a record to substantiate the claim.

The ATO will review these arrangements for the next financial year as the COVID-19 situation progresses.

This article originally appeared as “Here’s what you need to know about home offices claims for tax time”.