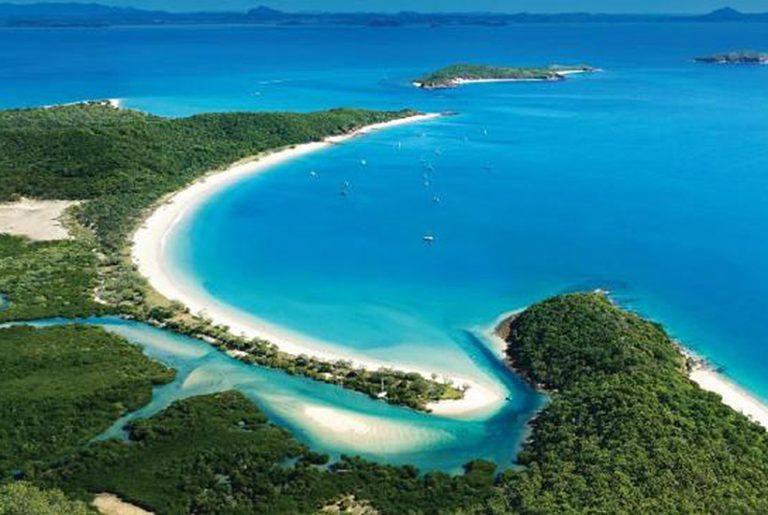

Great Barrier Reef’s Lizard Island close to sale

American hospitality giant Delaware North is toying with a plan to sell the 40-suite Lizard Island on the Great Barrier Reef to KSL Capital-controlled Baillie Lodges, which has embarked on a national expansion plan.

The on-again, off-again deal for the private equity player to buy Lizard Island is in line with Baillie Lodges’ strategy to establish a national network of upmarket luxury lodges. It is already represented on South Australia’s Kangaroo Island, on NSW’s Lord Howe Island and in Queensland’s Daintree, having recently bought Silky Oaks Lodge for more than $15 million.

Baillie Lodges founder and chairman James Baillie says Lizard Island will be a great addition to his portfolio of properties, which includes the flagship Southern Ocean Lodge and Longitude 131 in the shadow of Uluru.

Commercial Insights: Subscribe to receive the latest news and updates

“Lizard would be an amazing addition. We have been looking at a whole range of acquisitions including Lizard,” Baillie told The Australian yesterday.

“There’s ongoing discussions with a number of parties. KSL is also looking at a range of international options to purchase.”

Sources say Lizard Island is held by Delaware North on a sublease to a Hong Kong group that controls the head lease until 2033.

Jones Lang LaSalle vice-president Tom Gibson says there will be plenty more opportunities in the short to medium term for luxury lodge acquisitions by KSL.

But it is understood other Delaware properties such as Kings Canyon and El Questro will not be acquired by Baillie Lodges.

Baillie Lodges is also looking to develop boutique properties in Sydney’s The Rocks, Victoria’s Great Ocean Road and Western Australia’s Kimberley region.

“Ultimately, we are on track to be the most significant player in the luxury experiential space in Australia,” Baillie says.

Delaware North declined to comment on the Lizard Island deal last night.

Meanwhile, the carve-up of late construction tycoon Len Buckeridge’s property empire has gained momentum, with the BGC group selling a second Perth hotel for about $200 million.

Malaysia’s Starhill Hotel (Perth) and Starhill Hotel Operator (Perth) under YTL Hotels has bought Buckeridge’s 368-room Westin Perth for about $200 million in a deal done by JLL Hospitality.

BGC earlier sold the Aloft hotel and an office complex to Singaporean Hiap Hoe for $100 million.

BGC director Sam Buckeridge says the company’s board was pleased with the strong interest shown by potential buyers and the outcomes achieved in relation to both hotels, freeing up in excess of $300 million of capital for redeployment by BGC.

“We are very proud to have created two of Perth’s best hotel offerings, combining BGC Construction’s commitment to quality with Marriott’s fantastic service delivery,” Buckeridge says. The deal was brokered by JLL’s Mark Durran and John Williams.

– with Ben Wilmot

This article originally appeared on www.theaustralian.com.au/property.