In brief: Golf course or 1360 new houses in Hunter Valley?

A shovel-ready parcel of land with development approval for a golf course, 1364 houses, 85 tourist villages, a 150-room hotel, a vineyard and commercial and education precincts in the New South Wales Hunter Valley is up for grabs.

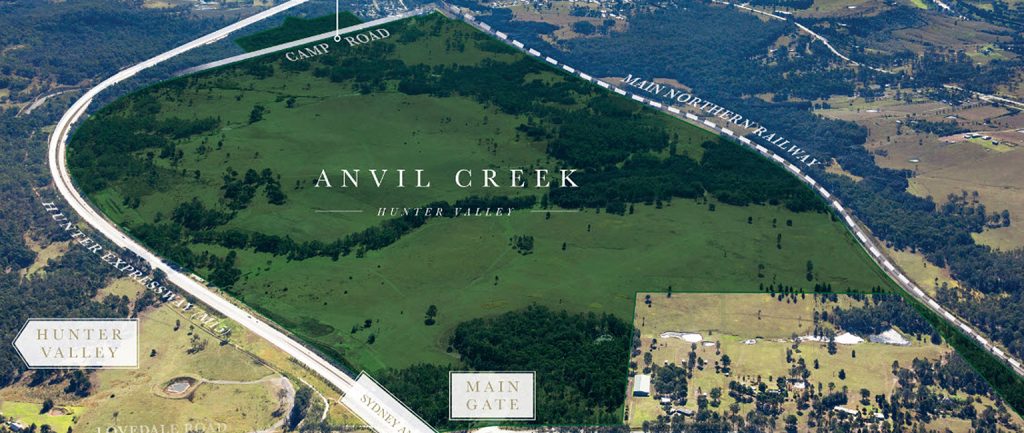

The 423ha tract of land in the Lower Hunter Valley, known as Anvil Creek, is being offered for sale by long-time owners the Windt family after a 15-year planning and rezoning process.

It is being marketed by Savills agents Stuart Cox and Neil Cooke, who say the land’s size mean the development options are almost limitless.

“The site has DA Approval for 1364 residential dwellings, 85 tourist villages, a 150 room dual key hotel, an 18-hole Graham Marsh-designed international standard golf course and clubhouse, 8,700sqm commercial and retail precinct, 16,000sqm education precinct and 20ha working vineyard,” Cooke says.

The property has been owned by the Windt family since 1980, and its gate sits directly opposite the main interchange for the new $1.7 billion M15 Hunter Expressway, which provides easy access to Newcastle and Sydney.

Anvil Creek is to be sold via an expressions of interest campaign, which ends on September 13.

Melbourne: Piece of Canterbury’s historic Malone Family Hotel sold

Two office suites within a historic former Canterbury hotel have sold at auction for $1.555 million.

The pair of suites, which were converted decades ago inside the heritage-listed building that was once the Malone Family Hotel, sold at auction on a 5.7% yield.

They were sold subject to a recently renewed lease to Canterbury Eye Specialists, which has occupied the offices for more than 20 years.

The former Malone Family Hotel in Canterbury is now a prominent commercial building.

Matt Hoath, from agents Gray Johnson, says the former hotel, which was built in 1889, is a local landmark in a premium location.

“The two combined ground floor suites are quality space leased as one feature, with marble checkerboard flooring, lofty ceilings and the original fireplaces while the tenant benefits from the natural light on two sides,” he says.

Victoria: Del Rios vineyard fetches $22m-plus

One of Australia’s largest vineyards, Del Rios, has sold for more than $22 million.

The vineyard, on the Murray River at Kenley, 77km north of Swan Hill, was sold to Melbourne-based agricultural developer and manager GoFarm Australia on behalf of Belvino Investments.

At nearly 900ha and with 5376 megalitres of water entitlements, the vineyard is one of Australia’s most significant, and is planted to chardonnay (39%), sauvignon blanc (20%), merlot (14%) and shiraz (8.5%).

The Del Rios vineyard has sold to a Melbourne company.

Colliers International’s Tim Altschwager and Nick Dean brokered the deal, with Altschwager saying the current global financial climate has further increased the attractiveness of Australian wineries.

“The solid enquiry we received is representative of increased interest in Australian wine industry assets, which is largely due to more favourable fundamentals, a lower Australian dollar, free trade agreements and the return of the US and UK to the market,” he says.

“Bulk wine stocks are currently low. We are receiving increased levels of enquiry for wine industry assets and, in particular, large scale warm climate vineyards that can produce high volumes of fruit to take advantage of increased overseas demand for fruit and wine.”

Brisbane: Healthy competition expected for Highpoint Ashgrove

An A-grade commercial and health precinct north-west of the Brisbane CBD is on the market, with expectations it will fetch around $35 million.

The 5079sqm facility, known as Highpoint Ashgrove, is being offered for sale for the first time and will be marketed to foreign investors.

Mike Walsh and Peter Court from CBRE Capital Markets have been appointed to negotiate the sale of the property, which is within a 10-minute drive to the CBD.

Walsh says the building attracts an annual rental income of $2.44 million and enjoys a secure tenancy profile, including BOQ, Brazilian Beauty, Ashgrove Family Practice, Attune Hearing and Revive Physiotherapy.

Brisbane office complex Highpoint Ashgrove is for sale.

“Approximately 50% of the building is underpinned by 10-year leases to ASX-listed Ardent Leisure and Metro Radiology, highlighting the defensive nature of the asset’s income security,” he says.

“With the building offering full occupancy, a long term WALE (weighted average lease expiry) and a history of strong retention, we expect widespread investor interest from local, national and offshore groups.”

The property will be sold via an international expressions of interest campaign that ends on September 1.

Melbourne: Investors to take shine to hair salon in upmarket Brighton

A Brighton retail property leased to national hair salon Toni & Guy is to be auctioned, with expectations it will sell for more than $2 million.

The shop on Church St features 122sqm of space and is leased at $92,472 per annum for the next five years, with a further five-year option.

It forms part of a retail and residential complex and includes five car parking spaces and two street frontages.

The Church St property features two street frontages.

Teska Carson’s George Takis, who is marketing the property with Michael Ludski, says few locales match Church St’s exclusivity.

“Church St is renowned Australia-wide for its broad cross-section of retail offering, which includes Coles and Woolworths, Witchery, Flight Centre, Country Road, Sportsgirl, Nike and the major banks, among many others, along with its intimate village atmosphere,’’ he says.

The shop will be auctioned on-site on Friday, September 2 at 1pm.

Victoria: Phillip Island resort puts leisure assets in focus

The management rights and more than half the apartments at the 4.5-star Silverwater Resort, at the gateway to Victorian tourist hotspot Phillip Island, have been listed for sale.

CBRE Hotels is marketing the renowned San Remo resort and function centre destination, with 97 of its 172 apartment keys up for grabs, along with its conference facilities, food and beverage facilities, business operations and management rights.

The rooms for sale are a mix of two and three-bedroom accomodation, ranging in size from 54sqm to 104sqm, while the other facilities include six large conference and meeting rooms, heated indoor and outdoor swimming pools, sports courts and a children’s playground. Among the conference facilities is the Bay View Room, which can seat up to 500 people.

San Remo’s Silverwater Resort is set to stir local and foreign investor interest.

CBRE’s Wayne Bunz says leisure assets have never been more highly sought after.

“What we’re now seeing is a rise in demand for leisure assets, particularly in light of the strong performance of key leisure destinations such as Cairns and the Gold Coast,” Bunz says.

“This has been highlighted by a string of recent sales, including Tradewinds Cairns and the Novotel Cairns in addition to Gold Coast transactions involving the Hotel Grand Chancellor, Surfers Paradise Marriott and Vibe Surfers Paradise.”