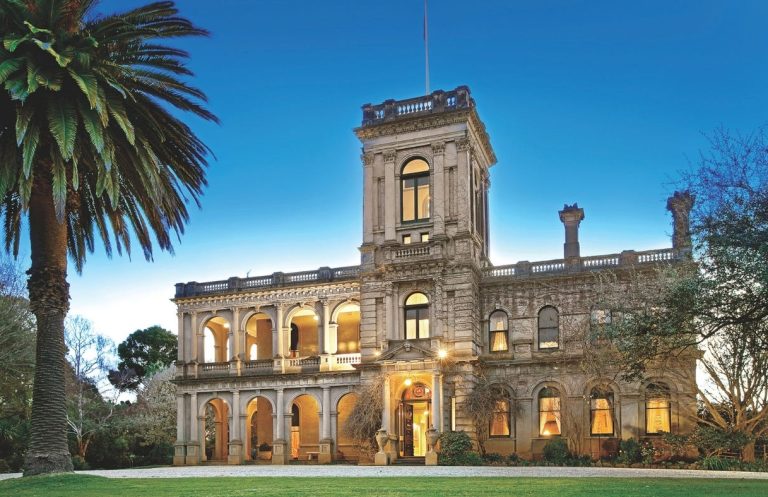

Operator wanted for Geelong’s 4.5-star Ritz apartment hotel

The management rights to operate the 4.5-star-apartment hotel in the tower to rise above Geelong’s Ritz Flats is on the market.

National hotel agents Jim Chapman and Tim Crooks, of Resort Brokers, are marketing the lease to operate the complex for $5.2 million, plus $680,000 for the manager’s residence and an office complex adjoining the reception area, both offered with freehold titles.

On offer is a 50-year caretaking and letting agreement comprising five 10-year terms and including a branding and signage package installed during construction.

Commercial Insights: Subscribe to receive the latest news and updates

The $30.8 million project is expected to be completed by the end of 2020, marking a new chapter for one of central Geelong’s most notorious landmarks.

The previous owner allowed the heritage-listed building to decay as a result of little maintenance and attacks by vandals and rough sleepers.

Income projections prepared by specialist management rights accountant Tony Rossiter of Holmans predict the caretaker could book a net profit of $1.29 million.

The agents are seeking an experienced owner-operator or accommodation group.

Integrated Development Solutions director Phillip Petch and agent Dale Whitford launch The Ritz development in Geelong. Picture: Jackie Paige Sanders.

The complex has 109 apartments, including 18 with dual keys.

The agents say Geelong’s overnight visitation rate has increased 4.5% a year since 2007, to 1.5 million a year.

Meanwhile, local agents are closing in on selling all the 109 apartments.

Whitford, Newtown agent Andrew Veronie says sales have been steady.

“We’ve got 16 apartments left, the majority are one-bedroom, and a couple of two-bedroom apartments remaining,” he says.

Most investors are from outside Geelong, he says.

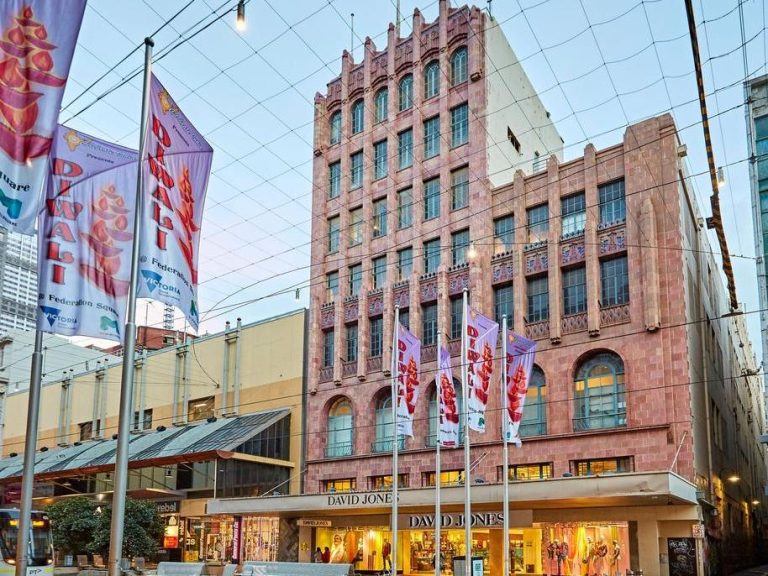

Geelong’s Ritz Flats as it looked in its heyday as the Bayview Temperance Hotel in about 1889.

The apartments are a proven product, with the developer’s other Geelong projects, Vue Apartments and Devlin Apartments, enjoying more than 90% occupancy rates, he said.

“The retail sector, especially the food industry has increased significantly in recent years.

“The style and types of cafes that are popping up are very Melbournesque and that’s feeding into the popularity of living here,” he said.

Remaining apartments are priced at $425,000 for a one-bedroom unit, plus a $13,000 furniture package, while two-bedroom apartments are $610,000, with $30,000 for furniture.

Veronie says estimated returns will be from 6-7%.

The project’s builder, Ireland Brown Construction, which is also working on the G1 Apartments, has leased a nearby property where it is fitting out site sheds.