Residential development on cards for Sydney Conference and Training Centre

Residential development is being touted for the Sydney Conference and Training Centre on the northern beaches.

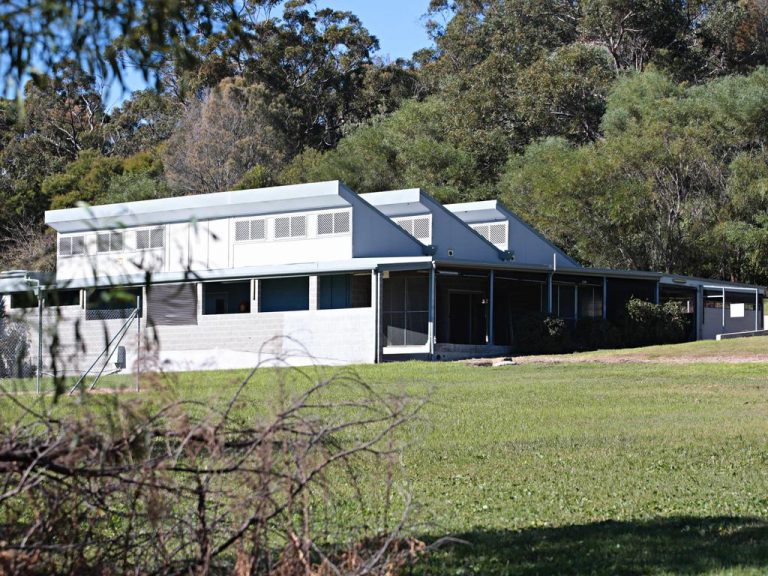

The former Westpac owned complex at 30 Ingleside Rd in Ingleside sits on 3.51ha and is being offered for the first time in about five years.

Sydney Conference and Training Centre is perched on top of a hill overlooking Narrabeen Beach and is made up of 56 four-star hotel rooms, a swimming pool, gym and several conference rooms.

The Ingleside complex is on 3.51ha.

The site has a long history of attracting Sydney’s corporate heavy hitters over the years and was previously Westpac’s in-house training centre for 20 years until they sold the complex in 2008.

Listed with CBRE — Hotel’s Raymond Tran, Andrew Jackson and Tom Gibson, the conference centre is being marketed as a rare opportunity to acquire 3.51ha of land in a “prime” northern beaches location.

It offers developers the chance to redevelop the existing conference centre or convert the site into a retirement home, aged care facility or house and land sub division. There is also the option to bank the land until it is rezoned.

Corporate heavy hitters from across Sydney frequently attend retreats at the conference centre.

Tran says he expects the buyer will be land banker who will use the centre in its current form until rezoning is complete.

“It is available to subdivide now, but if you wait a few years there is the option to undertake a more substantial development,” he says.

Despite the venue being forced to close earlier this year due to the outbreak of coronavirus, majority of land bankers are still attracted to the strong income on offer in the short term.

“The centre is used by many corporate heavy hitters as well as school and leisure groups,” Tran says.

Land bankers have made up majority of the interest so far.

There has also been inquires from major hotel brands interested in managing the complex and buyers from Asia looking to buy Australian real estate.

While no guide has been made public, CoreLogic shows the property last traded in 2016 for $13 million — the then suburb record.

Expressions of interest on the landholding are open until August 20.

This article from the The Daily Telegraph originally appeared as “Sydney Conference and Training Centre on the market with option for house and land subdivision”.