Dee Why Grand, Pacific Parade 19,

Dee Why, NSW 2099

Shops & Retail

Price information

Sold

Contact Agent

Key property information

Land area

Floor area

Parking info

Property extent

Tenure type

Sold on

JLL - Sydney

Level 27, 180 George StreetSYDNEY, NSW 2000

Dee Why Grand, Pacific Parade 19

Dee Why, NSW 2099

Map

CAMPAIGN CLOSED

- Highly affluent trade area

- Dual-supermarket anchored centre

- Tightly held Sydney-metro asset

JLL & Stonebridge are pleased to present for sale Dee Why Grand, a rare dual-supermarket neighbourhood centre in Sydney’s affluent northern beaches, 14 kilometres* from Sydney CBD. The Centre is a premier convenience offering and is the retail component of a thriving mixed-use development, comprising the Dee Why Hotel, a 10-storey office building, 170 residential apartments plus a three-level basement car park.

- Dominant dual-supermarket neighbourhood centre anchored by national heavyweights Coles and ALDI plus two mini-majors, 24 specialties and five kiosks across 9,976 sqm of GLA

- A triple street frontage and exposure to Pittwater Road, the main arterial road servicing the Northern Beaches with 175,000* daily passing vehicles

- Highly affluent total trade area of over 139,000 people with an average per capita income 19% above the Greater Sydney average 1

- Exceptional income security, 98% occupancy (by area), 5.3-year WALE (by area), average weighted rental increases of 3.4% and 94%* of income is underpinned by grocery, food, health and services

- Strong performing specialty stores with tenant productivity of $9,395/sqm*, 25% above benchmarks** and sustainable occupancy cost ratio of 13.5%

- Excellent parking provision for 412 basement car spaces on title ( 4.1 spaces per 100 sqm of lettable area)

- Institutional quality asset, managed by ISPT with $3.7 million common mall refurbishment completed and minimal future CAPEX requirements

- Estimated fully lease net income of $4.4 million* per annum as at 1-Jun-24

For further information or to arrange an inspection, please contact the exclusive selling agents.

* Approximate

1 LocationIQ Mar-24

2 Excluding Majors

3 Urbis benchmark for ‘Double Supermarket Based Shopping Centres’

Financial data as at 1-Jun-24; turnover figures as at Jan-24

- Dominant dual-supermarket neighbourhood centre anchored by national heavyweights Coles and ALDI plus two mini-majors, 24 specialties and five kiosks across 9,976 sqm of GLA

- A triple street frontage and exposure to Pittwater Road, the main arterial road servicing the Northern Beaches with 175,000* daily passing vehicles

- Highly affluent total trade area of over 139,000 people with an average per capita income 19% above the Greater Sydney average 1

- Exceptional income security, 98% occupancy (by area), 5.3-year WALE (by area), average weighted rental increases of 3.4% and 94%* of income is underpinned by grocery, food, health and services

- Strong performing specialty stores with tenant productivity of $9,395/sqm*, 25% above benchmarks** and sustainable occupancy cost ratio of 13.5%

- Excellent parking provision for 412 basement car spaces on title ( 4.1 spaces per 100 sqm of lettable area)

- Institutional quality asset, managed by ISPT with $3.7 million common mall refurbishment completed and minimal future CAPEX requirements

- Estimated fully lease net income of $4.4 million* per annum as at 1-Jun-24

For further information or to arrange an inspection, please contact the exclusive selling agents.

* Approximate

1 LocationIQ Mar-24

2 Excluding Majors

3 Urbis benchmark for ‘Double Supermarket Based Shopping Centres’

Financial data as at 1-Jun-24; turnover figures as at Jan-24

Property ID: 504557084Last Updated: 11 Sep 2024

JLL - SydneyLevel 27, 180 George Street

SYDNEY, NSW 2000

SYDNEY, NSW 2000

Stonebridge Property Group - SydneyLevel 7, 14 Martin Place

SYDNEY, NSW 2000

SYDNEY, NSW 2000

More properties from JLL - Sydney

Other properties you might be interested in based on the location and property type you are looking at.

Contact Agent

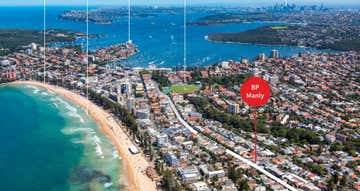

133-139 Pittwater Road, Manly, 133-139 Pittwater Road,Manly, NSW 2095 1099 m²Shops & Retail • Other • Development Sites & Land

Contact Agent

368 Pittwater Road,North Manly, NSW 2100 80 m²Shops & Retail • Development Sites & Land • Warehouse, Factory & Industrial